The Best 3D Printing Stocks

The Best 3D Printing Stocks of 2020: Are Any Buys for 2021?

As 2020 nears an end, we're going to look at the best-performing 3D printing stocks of the year, as of Dec. 24. Overall, this space outperformed the broader market. Moreover, the two biggest winners this year were also the two biggest winners over the last five years and deserve at least a place on investors' watch lists.

There's good reason to believe there will be some long-term winners in the group. The global market for 3D printing products and services is expected to reach nearly $41 billion in 2024, for a brisk compound annual growth rate of more than 26%, according to Statista.

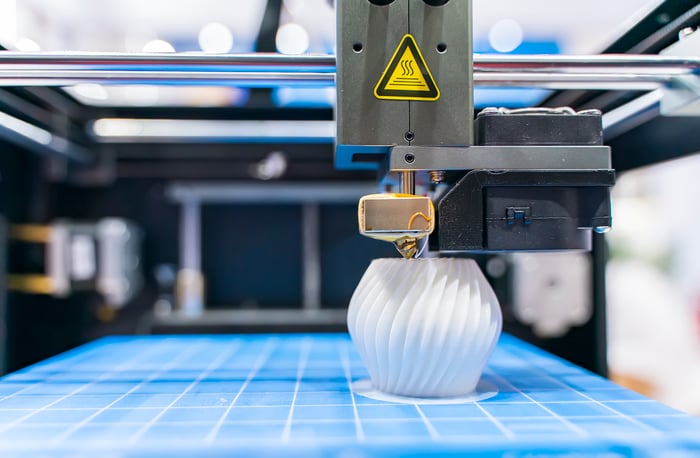

Image source: Getty Images.

3D printing stocks' 2020 performanceTo be included on the list, companies had to make products used for 3D printing or provide 3D printing services, and the size of their 3D printing business had to be fairly significant relative to their entire business. Moreover, their stocks had to have a market cap of at least $300 million (meaning they had to be at least small-cap stocks) and be publicly traded on a U.S. exchange since at least the start of 2020.

Company or ETF

Market Cap

Profitable (TTM)?

Wall Street's Projected 5-Year Annualized EPS Growth

2020 Return (Through Dec. 24)

5-Year Return

Materialise (NASDAQ:MTLS) $3.1 billion No63%

208% 669% Proto Labs (NYSE:PRLB) $4.6 billion Yes 25% 69.9% 163% The 3D Printing ETF (NYSEMKT:PRNT)$32.5 million net asset value

-- -- 43.4%N/A

3D Systems (NYSE:DDD) $1.4 billion No 10% 32% 10% Stratasys (NASDAQ:SSYS) $1.2 billion No 36% 6.9% (19.3%)S&P 500

-- -- -- 16.7% 98.5%Data sources: YCharts and Yahoo! Finance. ETF = exchange-traded fund. TTM = trailing 12 months. Returns that have beaten the S&P 500 are boldfaced. Data as of Dec. 24, 2020.

One note before we move on to our top three 2020 performers: Proto Labs is the only non-pure-play in the chart.

1. MaterialiseMaterialise, headquartered in Belgium, operates globally. It has three segments: 3D printing software, 3D printing manufacturing services, and medical. The last includes 3D-printing medical devices, providing 3D printing medical services, and selling 3D printing software for medical applications.

The company wasn't profitable from a standpoint of net income or earnings for the trailing 12 months, but it did generate positive free cash flow (FCF) over this period. Its business has performed better than 3D Systems and Stratasys for some time, though Proto Labs has performed the best of all these companies.

Like other 3D printing companies, Materialise's overall financial results have been hurt this year from the COVID-19 pandemic.

2. Proto LabsProto Labs, based in Minnesota, is a technology-enabled, quick-turn contract manufacturer of plastic and metal prototypes and short-production-run parts. It offers clients both traditional manufacturing and 3D printing services, and operates in the United States, Europe, and Japan.

The company's 3D printing services business competes against 3D Systems and Stratasys, along with other smaller players. But Proto Labs is also a customer of both 3D Systems and Stratasys, as it has many manufacturers' 3D printers in its factories.

In the third quarter of 2020, Proto Labs' 3D printing revenue accounted for 15.1% of its total revenue. While this is a relatively small percentage, this business has been growing faster than the company's combined traditional manufacturing services.

3. The 3D Printing ETFThe 3D Printing ETF, which began trading in July 2016, is the only exchange-traded fund focused on this space. It's not an actively managed fund, but rather tracks an index.

It had 51 stock holdings as of Dec. 23. Many of the companies are publicly traded in the U.S., though some are only traded on foreign stock exchanges. The top 10 holdings had a combined portfolio weight of about 52%, making it moderately concentrated. The top six holdings as of Dec. 23 were 3D Systems (7.3% weight), SLM Solutions (6.5%), Stratasys (5.5%), Proto Labs (5.2%), HP Inc. (5%), and Materialise (4.9%).

3D Systems and Stratasys sell products for 3D printing, including printers, software, and materials, and also provide on-demand 3D printing services. SLM Solutions, which is based in Germany and listed on the Frankfurt stock exchange, specializes in making metals 3D printers. HP entered the 3D printer market in 2016.

Many of the ETF's smaller holdings are companies that use 3D printing in their operations, rather than supply products for 3D printing. An example is Align Technology, the fund's 18th largest holding, accounting for about 1.6% of the portfolio value. Align uses 3D printing to make clear-plastic dental retainers.

Are any of these stocks a buy for 2021?Of the stocks listed in the chart, Proto Labs is probably the best choice for most investors. It's well run and consistently profitable, which sets it apart from the others. Investors comfortable with more risk and investing in companies that are not consistently profitable might also consider buying Materialise stock. The company is run by the founder and operates in some attractive niches.

Investors can also get exposure to 3D printing by buying stocks of companies whose businesses use the technology, such as Align.

The article was up to the point and described the information very effectively. Thanks to blog author for sharing an informative post. Nearest Printing Place